What caused the credit crunch?

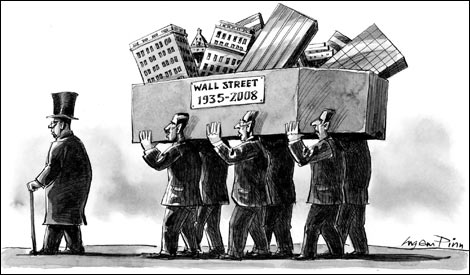

Due to the boom on housing market american mordgage lenders were giving money to people that did not actually have enough to give them back (ninja credits; no income, no job). The more they sold, the more they earned so obviously the sellers didn't care about nothing else but numebrs of given credits. In order to sell more risky mordgages, companies borrowed money from banks. Than other finantial companies bought those debts. The subprime (unsure) mordgages have usually a high risk rating, but vast companies that owned those mordgages paid the rating companies (S&P, Fitch and Moody's) billions of dollars in orderd to get the AAA rating (highest one). It is worth mentionig that it was legal. The financial system then didn't recognise the risk. A grat deal of the mortgages had an introductionary period, when the interest rates are much lower. After some time (1-2 years) the i.r. get higher so the mortgage got more expensive for those who paid them. In 2007 US government rised he interest rates, because of the inflation. It made the mortgages even more expensive so many howsowners, whose introductionary periods ended, were virtually affected by the double increase of their installments price. A lot of people could not afford to pay back any more which ment that banks simply stopped receiving money. That caused a chain reaction, many financial institutions stopped receiving founds from their lenders and eventually went bankrupt. Major banks, like Lehman Brothers, lost their customers savings. Some insurance institutions, like AIG, which imperfed the subprime mortgages fell too. The wave of collapsion spread all over the world and that is how the crisis was created.

Due to the boom on housing market american mordgage lenders were giving money to people that did not actually have enough to give them back (ninja credits; no income, no job). The more they sold, the more they earned so obviously the sellers didn't care about nothing else but numebrs of given credits. In order to sell more risky mordgages, companies borrowed money from banks. Than other finantial companies bought those debts. The subprime (unsure) mordgages have usually a high risk rating, but vast companies that owned those mordgages paid the rating companies (S&P, Fitch and Moody's) billions of dollars in orderd to get the AAA rating (highest one). It is worth mentionig that it was legal. The financial system then didn't recognise the risk. A grat deal of the mortgages had an introductionary period, when the interest rates are much lower. After some time (1-2 years) the i.r. get higher so the mortgage got more expensive for those who paid them. In 2007 US government rised he interest rates, because of the inflation. It made the mortgages even more expensive so many howsowners, whose introductionary periods ended, were virtually affected by the double increase of their installments price. A lot of people could not afford to pay back any more which ment that banks simply stopped receiving money. That caused a chain reaction, many financial institutions stopped receiving founds from their lenders and eventually went bankrupt. Major banks, like Lehman Brothers, lost their customers savings. Some insurance institutions, like AIG, which imperfed the subprime mortgages fell too. The wave of collapsion spread all over the world and that is how the crisis was created.

No comments:

Post a Comment